Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Central Bank of India acquires Future Enterprise Limited’s 25.18% stake in Future Generali India Life Insurance, marking a strategic move to strengthen its presence in the insurance sector.

Why Choose Generali Central Long Term Income Plan?

An Individual, Non-Linked, Non-Participating (without profits), Savings, Life Insurance Plan.

When your dreams span decades, your protection and income should too.

As you grow in life, your goals evolve, responsibilities shift, and your loved ones remain your top priority.

The Generali Central Long Term Income Plan offers guaranteed income, life cover, and enduring financial support—so you can live life on your terms and protect what matters most.

Start receiving income as early as next month, with payouts that grow over time.

Whether you're planning for retirement, securing your child's future, or building a legacy, this plan ensures stability, confidence, and care that stays with your family—even in your absence.

Income up to 50 Years

Get guaranteed, growing income for up to 50 years.

Customisable Plan Options

Choose benefits, payout style, and term as per your goals.

Uninterrupted Financial Security*

Your family will continue receiving income without paying premiums in your absence.

Life Cover up to 100 Years#

Enjoy life insurance even while receiving regular income.

Tax Savings

Eligible for tax benefits on premiums and payouts.

Flexible Payout Frequency

Choose yearly, half-yearly, quarterly, or monthly payouts.

Optional Riders

Boost coverage with accident and disability protection add-ons.

Flexible Premium Payment

Choose between yearly, half-yearly, quarterly, or monthly premiums.

Loan Facility

Get quick funds by borrowing against your policy.

*- Uninterrupted Financial Security – available for option 2 #- Life Cover up to 100 Years – available for option 1

A Roadmap to a Secure Future

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

Tailored Plan Options to Secure Your Future

Choose the policy option that fits your life goals.

Option 1

Secure peace of mind with regular payouts and a maturity benefits, and if life takes an unexpected turn, your nominee is protected too.

Minumum:

0 years (Death Benefit Multiple 10),

41 years (Death Benefit Multiple 7),

50 years (Death Benefit Multiple 5)

Maximum:

60 years (Death Benefit Multiple 10),

65 years (Death Benefit Multiple 7),

65 years (Death Benefit Multiple 5)

30-100 years

Minimum:

Age: 0 days-50 years

₹2,208

Age: 51-65 years

₹4,415

Maximum: No Limit (As per Board Approved Underwriting Policy)

Option 2

Even when life doesn’t go as planned, you can protect your family’s future with continued benefits and no premium burden. It’s a thoughtful way to keep their dreams on track, no matter what.

Min: 18 years (Death Benefit Multiple 10)

Max: 45 years (Death Benefit Multiple 10)

48-85 years

Minimum:

Age: 0 days-50 years

₹4,415

Maximum: No Limit (As per Board Approved Underwriting Policy)

Offered Across All Plans

Offered Across All Plans

8 or 10 years

30 or 40 or 50 years

Limited Pay

₹ 2,00,000 to No Limit (As per Board Approved Underwriting Policy)

Yearly, Half Yearly, Quarterly, and Monthly

1. For minors, the date of issuance of policy and date of commencement of risk shall be the same.

2. Premiums mentioned above are excluding the applicable taxes, rider premiums, and underwriting extra premiums, if any.

3. Age, wherever mentioned is age as on last birthday.

Benefits of Generali Central Long Term Income Plan

Here’s how this plan helps you secure your goals and safeguard your loved ones:

You will receive Survival Benefit till the end of the Policy Term as per the Income Option and Survival Benefit

Payout frequency you have chosen.The plan offers two Income Options to choose from:

Income Options to Choose From

Immediate Income

- Payouts start immediately after policy inception

- Frequency: Yearly, Half-Yearly, Quarterly, or Monthly.

Example:

- Monthly payout begins at the end of the first policy month.

- Yearly payout begins at the end of the first policy year.

Deferred Income

- Payouts start 5 years after the policy inception

- Frequency: Yearly, Half-Yearly, Quarterly, or Monthly.

Example:

- Monthly payout starts at the end of the 61st policy month.

- Yearly payout begins at the end of the 6th policy year.

Guaranteed Income

The Guaranteed Income varies based on Annualized Premium (excluding applicable taxes, rider premiums, loadings for modal premium, and underwriting extra premiums, if any), Plan Option, Income Option, Entry age of Life Assured, Policy Term, Premium Payment Term and Death Benefit Multiple Option.

Income Loyalty Addition

The Income Loyalty Addition shall enhance the Survival Benefit payable starting from the 11th policy year till the end of the Policy Term, subject to payment of all due premiums. The Income Loyalty Addition is defined as a percentage of Guaranteed Income as mentioned below

Income Loyalty Addition as a percentage of Guaranteed Income

30 years

40 years

50 years

You will receive the Total Maturity Benefit at the end of the Policy Term, provided all due premiums are paid.

Total Maturity Benefit = Sum Assured on Maturity + Guaranteed Loyalty Additions

- Sum Assured on Maturity (A multiple of the Annualized Premium (excluding taxes, rider premiums, and underwriting loadings).)

- Guaranteed Loyalty Additions (Additional benefit equal to the sum assured.)

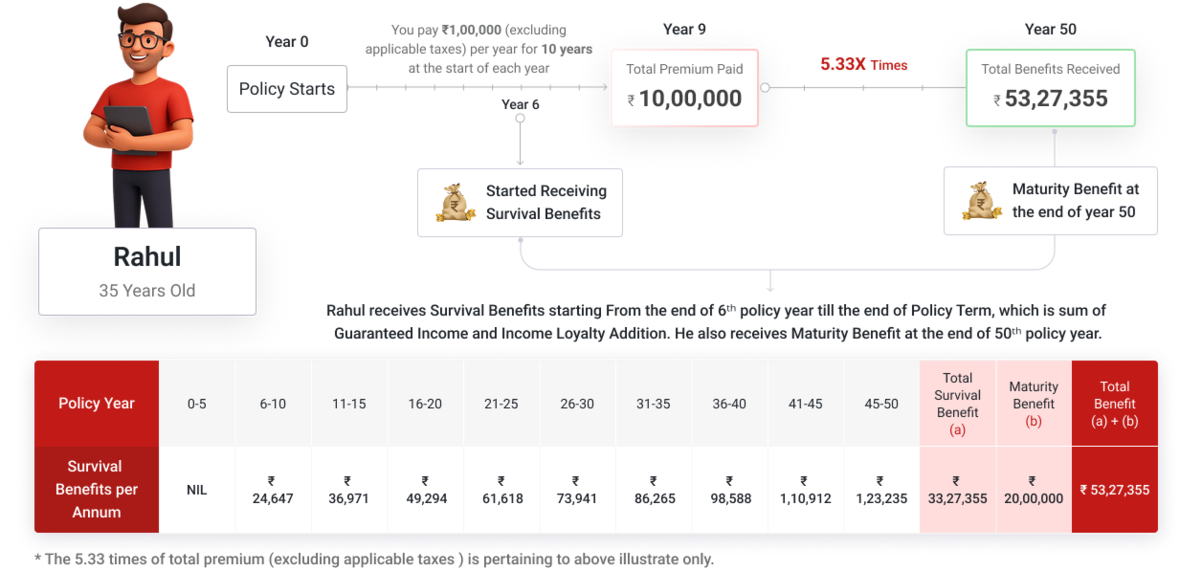

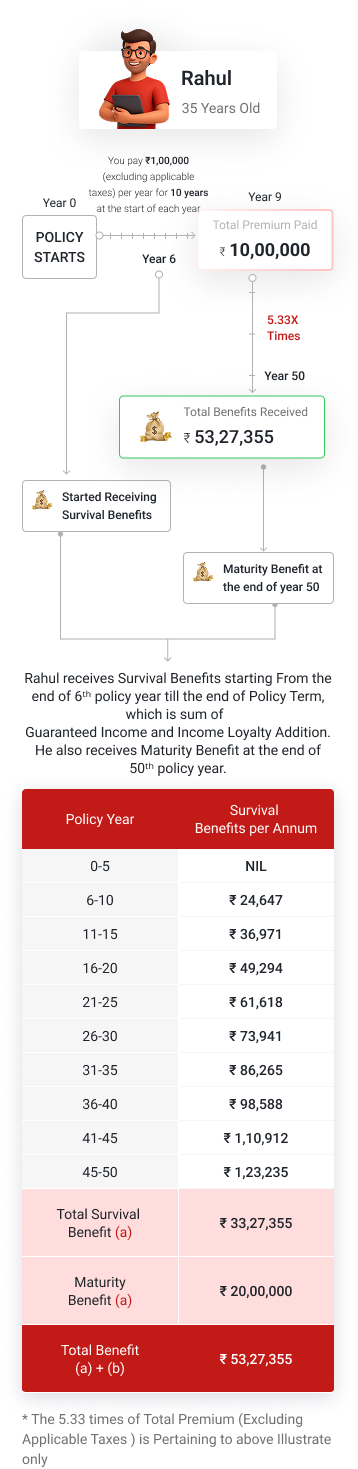

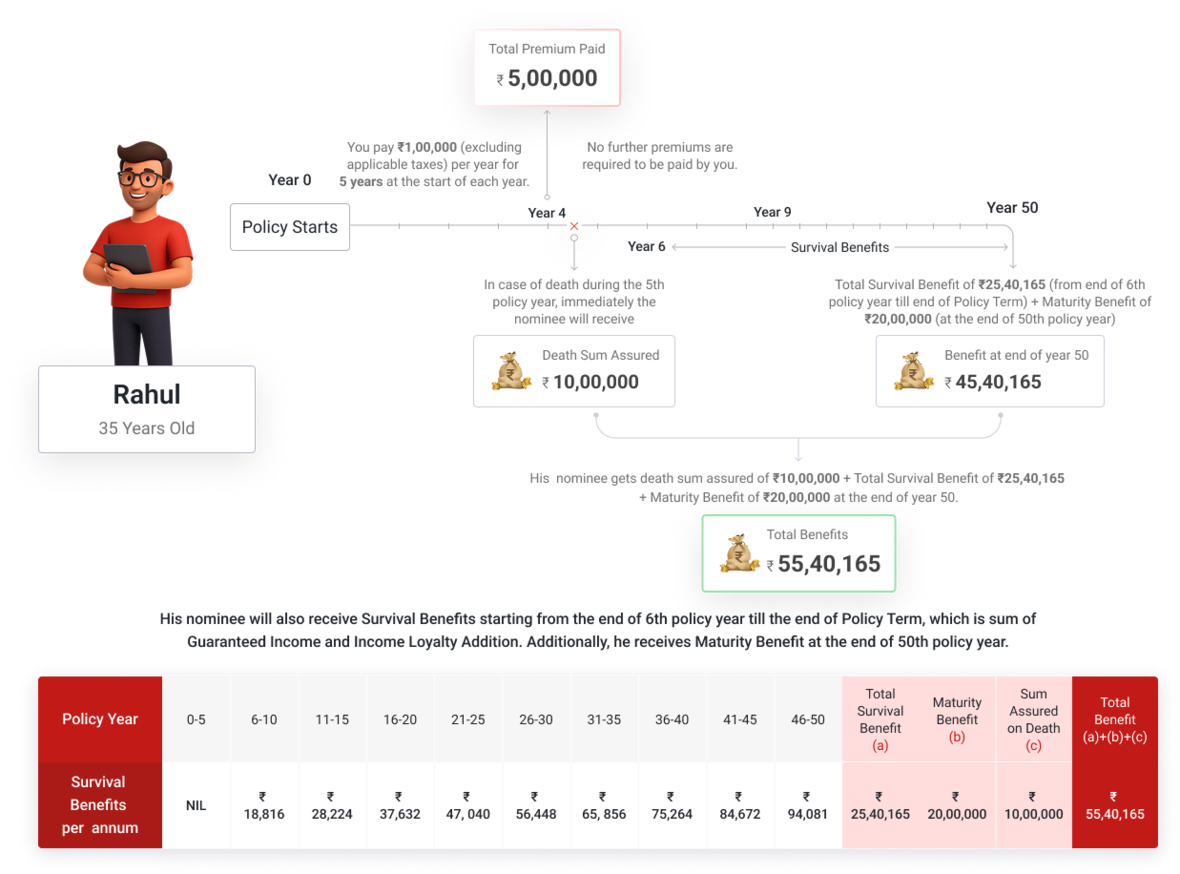

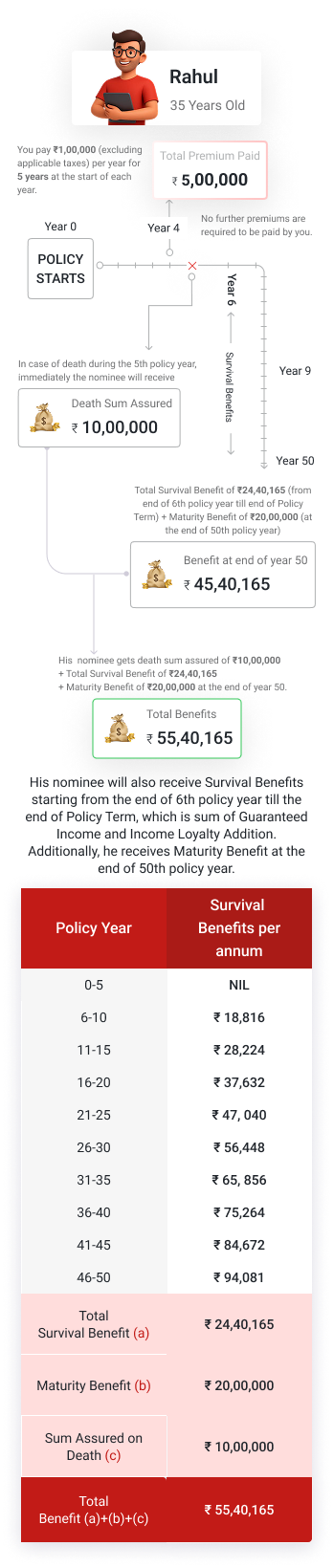

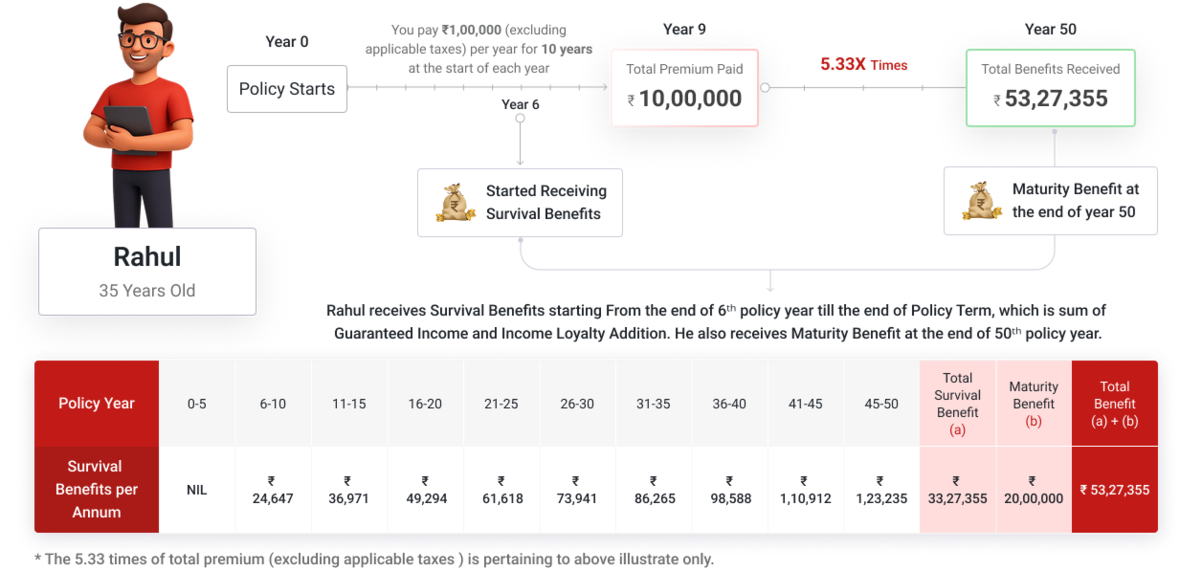

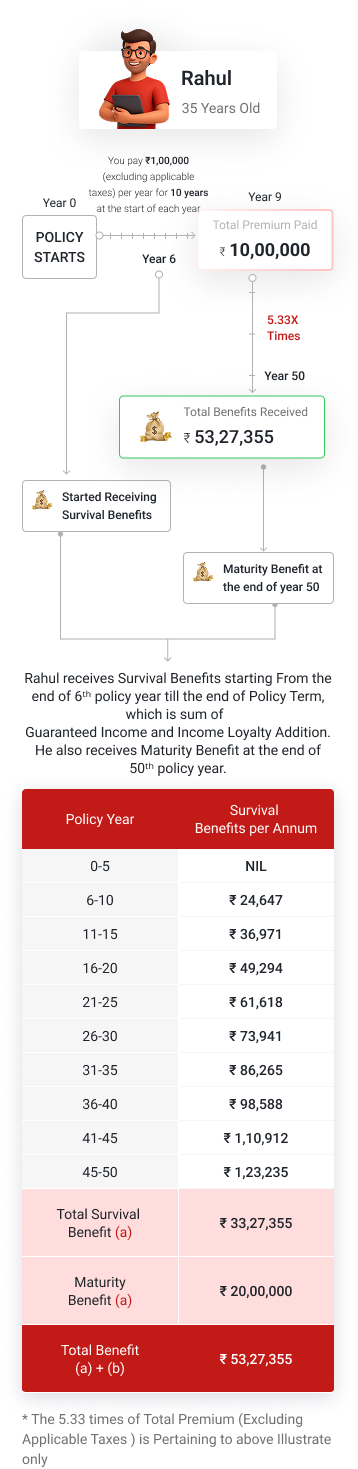

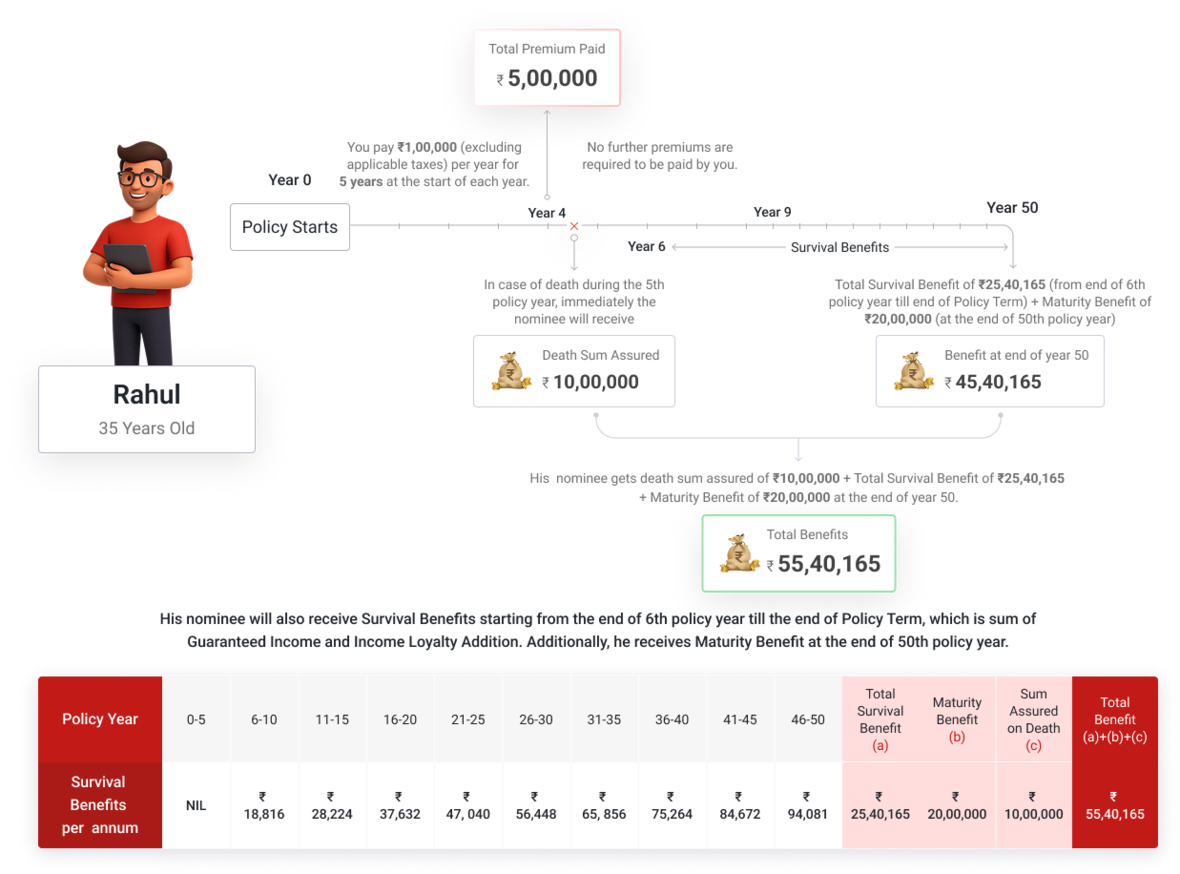

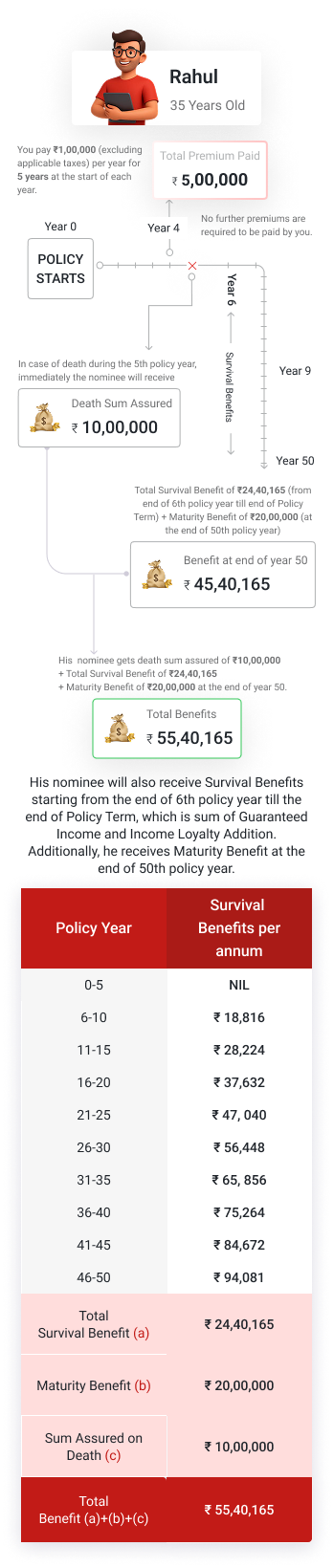

Rahul’s Example

To clearly understand how maturity benefit works in this case, let us look at Rahul’s story

Scenario 1: Option 1 with Deferred Income

Rahul, a 35 years old healthy man purchased Generali Central Long Term Income Plan – Option 1 with Deferred Income option. He opted for an Annualized Premium (excluding applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 1,00,000 for a Premium Payment Term of 10 years, Policy Term of 50 years and Yearly Survival Benefit payout frequency. His Death Benefit Multiple is 10 times, thus the Sum Assured will be Rs. 10,00,000 and his Guaranteed Income will be Rs. 24,647 per annum.

1. Survival Benefits annually from the end of the 6th policy year till the end of the 50th policy year

2. Maturity Benefit at end of the Policy Term

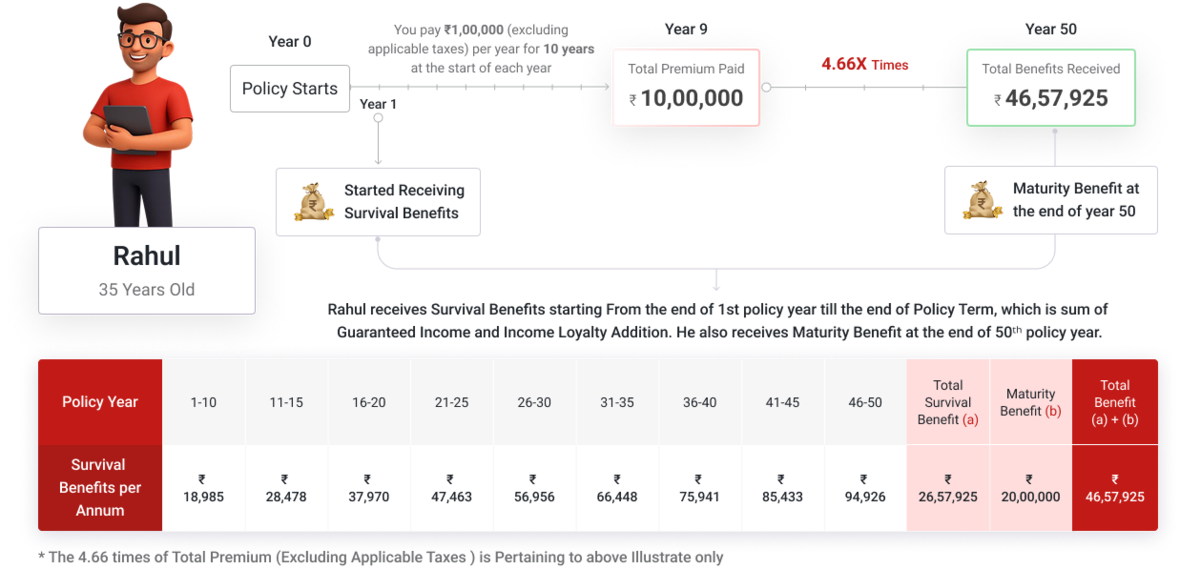

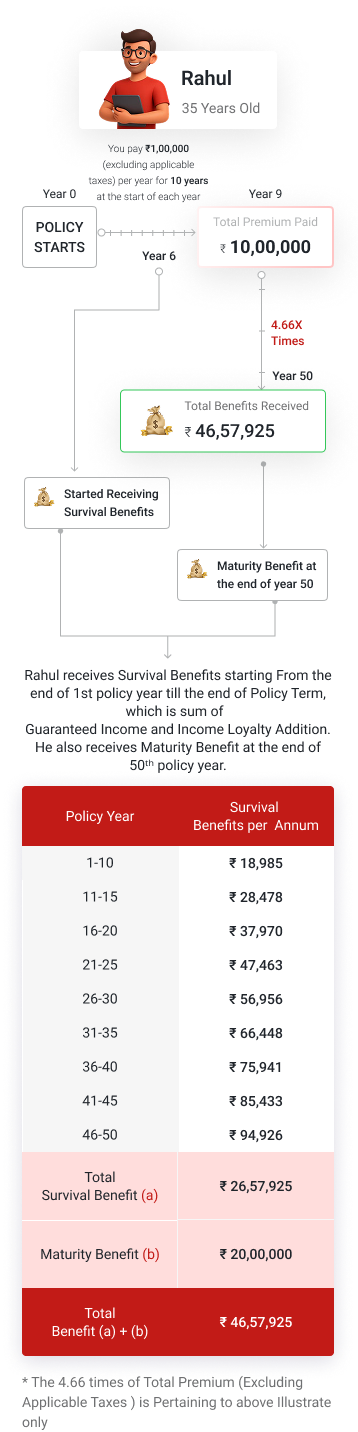

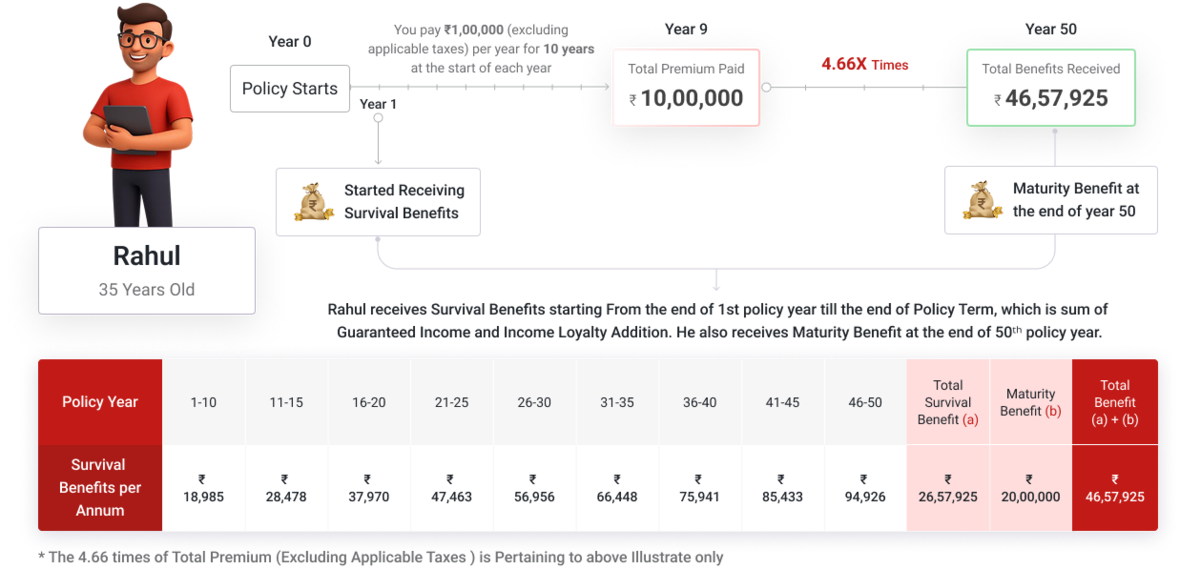

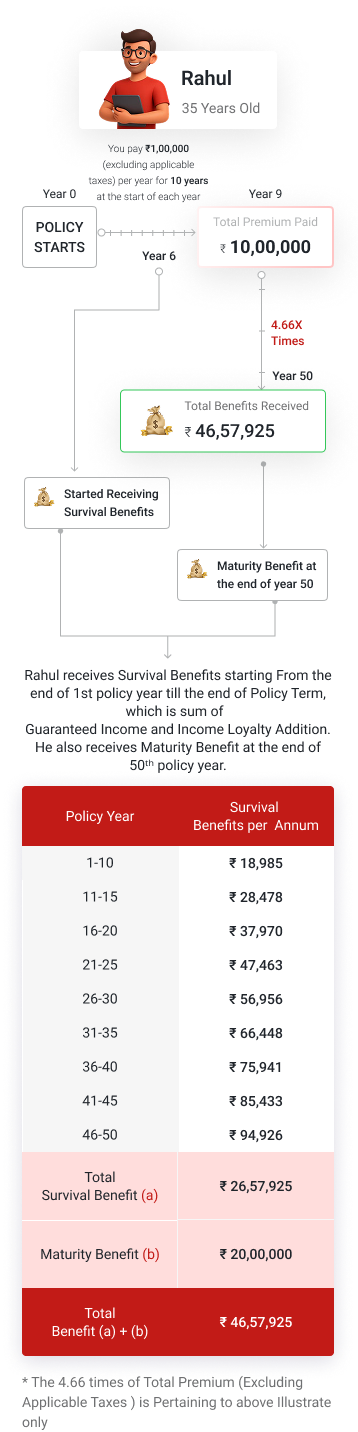

Scenario 2: Option 1 with Immediate Income

If Rahul, a 35 years old healthy man, purchases Generali Central Long Term Income Plan – Option 1 with Immediate Income option and opts for an Annualized Premium (excluding applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 1,00,000 for a Premium Payment Term of 10 years, Policy Term of 50 years and Yearly Survival Benefit payout frequency. His Death Benefit Multiple is 10 times, thus his Sum Assured will be Rs. 10,00,000 and his Guaranteed Income will be Rs. 18,985 per annum.

It is assumed that Rahul’s death occurs in the 5th policy year. The benefit payable under Option 2 to Rahul’s nominee(s) will be:

Let’s understand the benefits under all Plan Options and Income Options for a 35 years old healthy individual who opts for a Premium Payment Term of 10 years,

Policy Term of 50 years and Yearly Survival Benefit payout frequency, Death Benefit Multiple is 10 times and pays an annual premium of Rs. 1,00,000 per year.

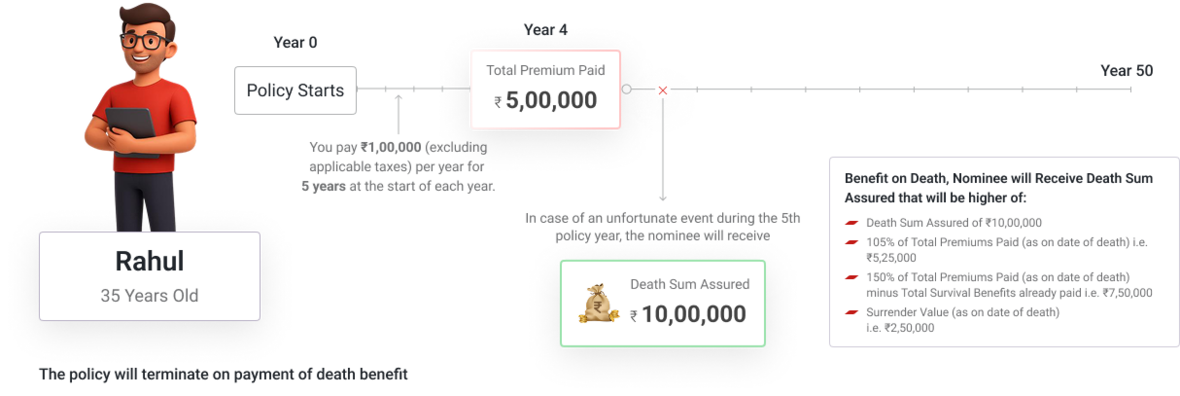

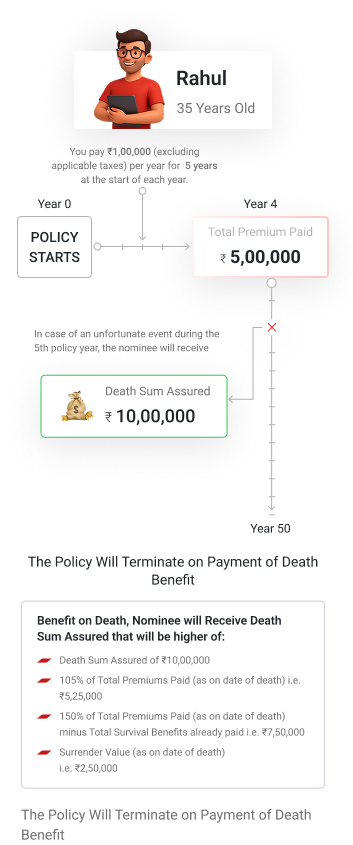

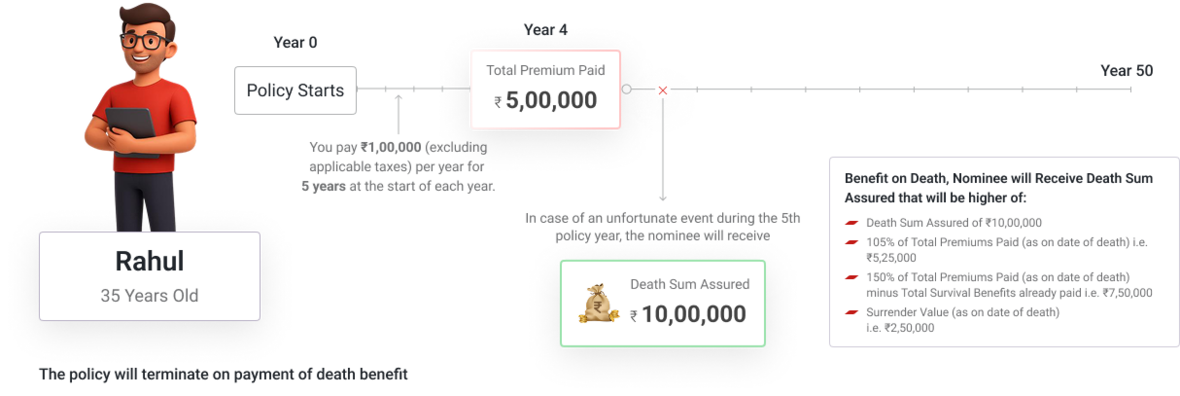

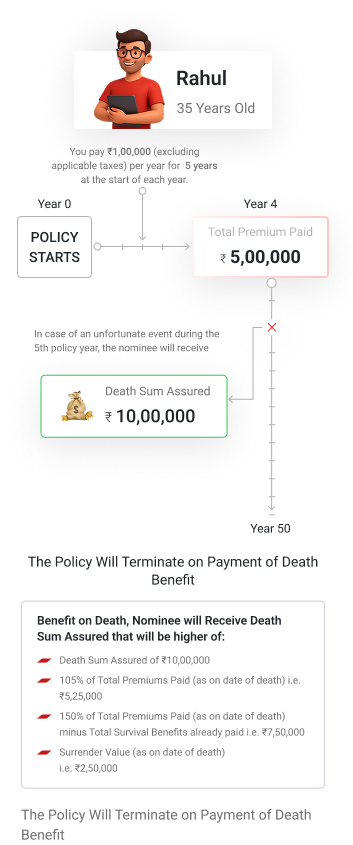

In the event of an unfortunate event during the policy term, your family will receive financial support through the Death Benefit as per the plan option selected.

Sum assured on death is defined as a multiple of the annualised premium (excluding applicable taxes, rider premiums and underwriting extra premiums, if any)

Option 1

- Sum assured on death or

- 105% of total premiums paid (excluding applicable taxes and extra premiums, collected explicitly) as on date of death or

- 150% of total premiums paid (excluding applicable taxes and extra premiums, if collected explicitly) as on the date of death minus the total survival benefit already paid or

- Surrender value as on the date of death

The policy will terminate on payment of the entire Death Benefit as defined above.

Option 2

- A lump sum payout equal to the sum assured on death will be paid at the time of settlement of death claim.

- The policy will continue to pay the Survival Benefits until the end of the Policy Term, along with the Maturity Benefit as scheduled.

- No future premiums are required to be paid after the death of the Life Assured.

The policy will terminate on payment of the entire Death Benefit as defined above, the nominee will have no right to surrender or alter any of the conditions of the policy after the death of the Life Assured

Rahul’s Example

To clearly understand how death benefit works in this case, let us look at Rahul’s story

Scenario 1: Option 1 with Deferred Income

Rahul, a 35 years old healthy man, purchased Generali Central Long Term Income Plan – Option 1 with Deferred Income option. He opted for an Annualized Premium (excluding applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 1,00,000 for a Premium Payment Term of 10 years, Policy Term of 50 years, and Yearly Survival Benefit payout frequency. His Death Benefit Multiple is 10 times and Sum Assured on Maturity will be Rs. 10,00,000 and his Guaranteed Income will be Rs. 24,647 per annum.

It is assumed that Rahul’s death occurs in the 5th policy year. The benefit payable under Option 1 to Rahul’s nominee(s) will be:

Scenario 2: Option 2 with Deferred Income

If Rahul, a 35 years old healthy man, purchased Generali Central Long Term Income Plan – Option 2 with Deferred Income option and opts for an Annualized Premium (excluding applicable taxes, rider premiums, loadings for modal premium and underwriting extra premiums, if any) of Rs. 1,00,000 for a Premium Payment Term of 10 years, Policy Term of 50 years, and Yearly Survival Benefit payout frequency. His Death Benefit Multiple is 10 times and Sum Assured on Maturity will be Rs. 10,00,000 and his Guaranteed Income will be Rs. 18,816 per annum.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

1369

1369Branches across India

897,635

897,635Lives Protected from Day One

₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

99.78%

99.78%Group Claim Settlement Ratio

Data as on 31st March, 2025

Downloads

Everything you need to understand your policy, plan your future, and make informed decisions at your convenience.

Important Information & Resources

Understand your policy better with key details and insights into the Generali Central Long Term Income Plan.

Free Look Period

If you disagree with the terms and conditions of the policy, you can return the policy within 30 days of receipt of the Policy Document (whether received electronically or otherwise).. To cancel the policy, you can send us a request for cancellation along with the reason for cancellation. We will cancel this policy if you have not made any claims and refund the Instalment Premium received after deducting proportionate risk premium for the period of cover, stamp duty charges and expenses incurred by us on the medical examination of the Life Assured (if any).

If the policy is opted through Insurance Repository (IR), the computation of the said Free Look Period will be as stated below:-

- For existing e-Insurance Account: Computation of the said Free Look Period will commence from the date of delivery of the e-mail confirming the credit of the Insurance policy by the IR.

- For New e-Insurance Account: If an application for e-Insurance Account accompanies the proposal for insurance, the date of receipt of the ‘welcome kit’ from the IR with the credentials to log on to the eInsurance Account (eIA) or the delivery date of the email confirming the grant of access to the eIA or the delivery date of the email confirming the credit of the Insurance policy by the IR to the eIA, whichever is later shall be reckoned for the purpose of computation of the Free Look Period.

Grace Period

You get a grace period of 30 days for Annual, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, risk on your life will continue to be covered and your nominee will be entitled to receive all the benefits subject to deduction of due premiums.

Flexibility to choose Survival Benefit Frequency

You can change the frequency at which you receive the Survival Benefit anytime during the Policy Term. The revised frequency of Survival Benefit payouts shall be applicable from the policy anniversary.

The Survival Benefit as a percentage of Annual Survival Benefit shall be as follows:

- Yearly - 100% of Annual Survival Benefit in arrears

- Half-yearly - 49% of Annual Survival Benefit every six months in arrears

- Quarterly - 24.25% of Annual Survival Benefit every three months in arrears

- Monthly - 8% of Annual Survival Benefit every month in arrears

There shall be no charge made for the change of Survival Benefit payout frequency.

The payment of Survival Benefit is subject to deduction of any outstanding dues from the Policyholder including but not limited to outstanding Policy loan, loan interest or any other dues and applicable taxes, if any.

Change in Premium Payment Frequency

You can change your premium payment frequency subject to minimum eligibility criteria. Such change shall be applicable from the policy anniversary.

The premiums for various modes as up to percentage of annual premium are given below:

- Half-yearly Premium - 52.0% of annual premium

- Quarterly Premium - 26.5% of annual premium

- Monthly Premium - 8.83% of annual premium

There shall be no charge made for the change of premium payment frequency.

The company will offer waiver of modal premium loadings for Annualized Premium of Rs. 1 crore and above.

Non Payment of Due Premium

Lapse:

If due premiums for the first (1) policy year has not been paid in full within the grace period, the policy shall lapse and will have no value.

All risk cover ceases while the policy is in lapsed status.

Survival Benefit payable, shall also stop once the policy is in Lapsed status.

The policyholder has the option to revive a lapsed policy within five (5) years from the due date of the first unpaid premium.

In case the policy is not revived during the revival period, no benefit shall be payable at the end of the revival period and the policy stands terminated thereafter.

Paid-Up:

If due premiums for the first (1) or more policy years have been paid in full and any subsequent due premium is not paid within the grace period, the policy will be converted into a reduced paid-up policy.

If a policy is converted into a reduced paid-up policy, Sum Assured on Death, Survival Benefits and Sum Assured on Maturity will be reduced.

A paid-up policy will not be eligible for any Income Loyalty Addition or Maturity Loyalty Addition.

a. Paid Up Death Benefit:

Suicide exclusion:

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the policy or from the date of revival of the policy, as applicable, the nominee or beneficiary of the policyholder shall be entitled to at least 80% of the total premiums paid till the date of death or the surrender value available as on the date of death whichever is higher, provided the policy is in force.

Prohibition on rebates:

Section 41 of the Insurance Act 1938 as amended from time to time states:

- No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.

- Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to ten lakh rupees.

Fraud and Misstatement

Section 45 of the Insurance Act 1938, as amended from time to time, states:

- No policy of Life Insurance shall be called in question on any ground whatsoever after the expiry of 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.

- A policy of Life Insurance may be called in question at any time within 3 years from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later, on the ground of fraud.

For further information, Section 45 of the Insurance Laws (Amendment) Act, 2015 may be referred.

Grievance Redressal Processes

In case you have any grievances on the solicitation process or on the Product sold or any of the Policy servicing matters, you may approach the Company in one of the following ways:

- Dial the Customer helpline number 1800-102-2355 for assistance and guidance

- Email at care@generalicentral.com

- Visit us at the nearest Branch Office. Branch locator - https://www.generalicentrallife.com/branch-locator

- Senior citizens can write in at the following ID: senior.citizens@generalicentral.com for priority assistance

- Write to us at: Customer Services Department- Generali Central Life Insurance Company Limited, Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400083

Generali Central Life Insurance Company Limited (Formerly known as ‘Future Generali India Life Insurance Company Limited) offers a wide range of life insurance solutions designed to protect and empower individuals at every stage of life. Whether it’s protecting your loved ones, planning for retirement, or securing long-term financial well-being, our offerings are designed to evolve with your needs. Backed by a robust distribution network and advanced digital tools, we are dedicated to delivering simplicity, innovation, empathy, and care in every experience — all anchored by our unwavering commitment to being your Lifetime Partner.

This commitment is backed by the strength of our joint venture between Generali, a global insurance leader with over 190 years of expertise, and Central Bank of India, a trusted name with a rich legacy in Indian banking.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: https://www.generalicentrallife.com/customer-service/grievance-redressal-procedure. Central Bank of India’s and Generali Group’s liability is restricted to the extent of their shareholding in Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited (IRDAI Regn. No. 133), CIN: U66010MH2006PLC165288, Regd. and Corporate Office address: Unit 801 and 802, 8th floor, Tower C, Embassy 247 Park, L.B.S. Marg, Vikhroli (W), Mumbai – 400 083 | Email: care@generalicentral.com | Call us at 1800-102-2355 | Website: www.generalicentrallife.com | Fax: 022-40976600 | UIN: 133N090V05

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

The Generali Central Long-Term Income Plan offers financial security for your family, even if you're not around. With Option 2, you won't have to pay future premiums, and the benefits will continue, ensuring steady support for your loved ones.

No, once you select your plan option (1 or 2), it can’t be changed later.

That’s why we’re here to help—connect with our insurance expert to understand what works best for you and choose a plan that truly fits your needs.

The minimum premium starts at ₹25,000 annually and depends on factors like age, policy term, and benefits selected. You can choose to pay premiums Yearly, Half-Yearly, Quarterly, or Monthly, offering flexibility based on your financial planning and cash flow preferences while securing a guaranteed minimum income for your future needs.

With deferred income, your payouts will start after 5 policy years. From the 11th year, you’ll also receive the extra income called Loyalty Additions, which grow over time.