Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Have a life goal in mind? Let Generali Central Life Insurance help you plan it right.

Our Promise is Reflected in the Lives We've Touched

We bring experience, stability, and a proven approach to supporting your family and financial goals.

6019

6019Our and Partners Branches

897,635

897,635Lives Protected

FY 24-25 ₹87.84 Bn

₹87.84 Bnof Assets Under Management

98.08%

98.08%Individual Claim Settlement Ratio

FY 24-25 99.78%

99.78%Group Claim Settlement Ratio

FY 24-25Data as on 31st March, 2025

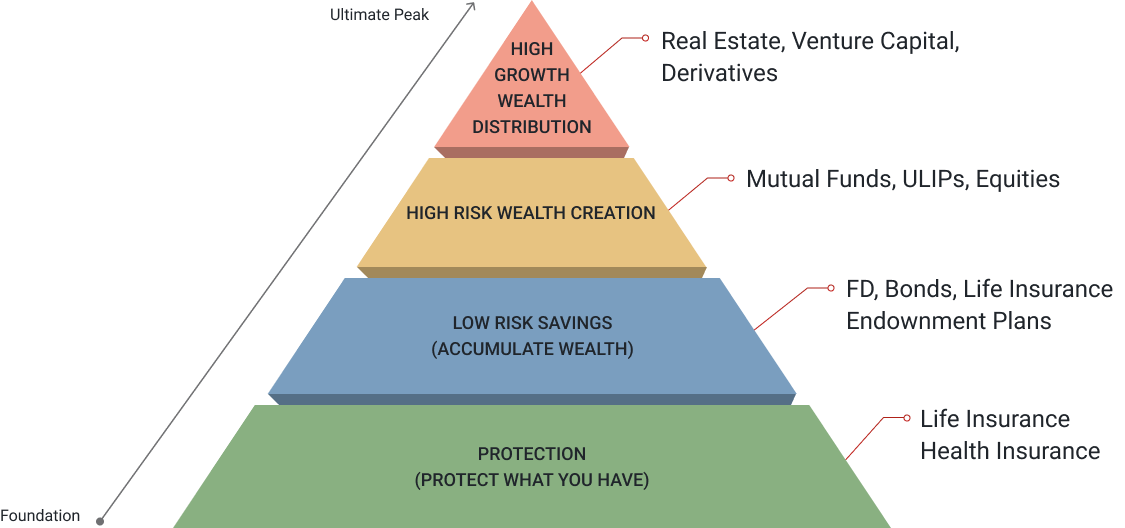

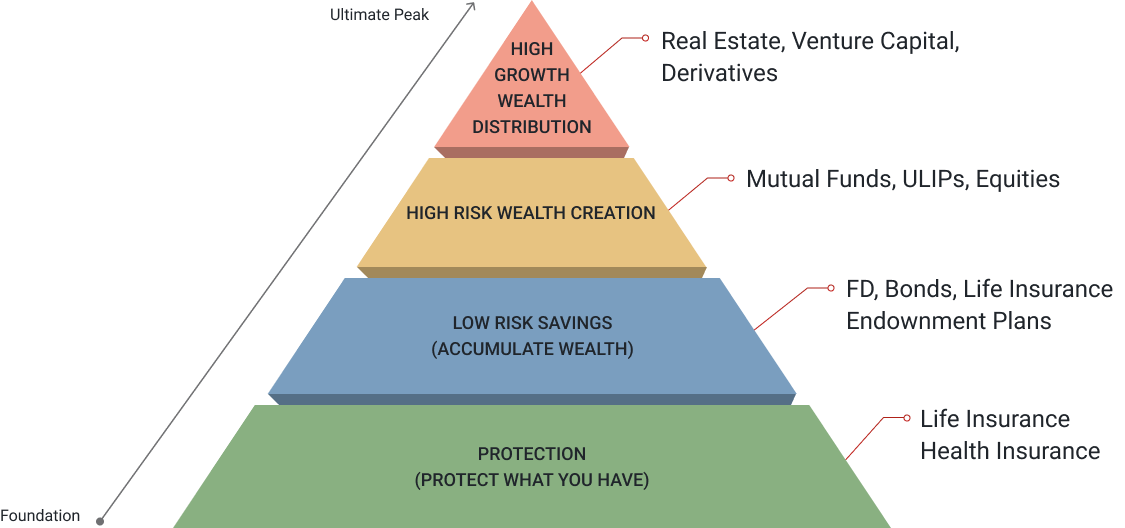

Here’s How to Grow Safely, Smartly and Financially

This pyramid helps you understand how to layer protection, savings and investments the right way.

About Generali Central Life Insurance

Generali Central Life Insurance Company Limited (Formerly known as Future Generali India Life Insurance Company Limited), headquartered in Mumbai, is one of the leading insurance companies in India. It brings together the global leadership and legacy of Generali and the strength of Central Bank of India, one of the oldest nationalized banks in India.

Founded in 1831, Generali is the majority shareholder with a stake of 73.99%. It brings deep insurance expertise along with best practices from its global network, driving sustainable and profitable growth for its stakeholders. Central Bank of India, established in 1911, holds a 25.18% stake in the company. Its extensive distribution network of over 4,500 branches, along with a wide array of financial products and services, is designed to meet diverse customer needs. With a strong presence across India, Generali Central Life Insurance Company Limited provides comprehensive life insurance solutions for both individuals and groups. Reflecting a strengthened commitment to be your Lifetime Partner, the life insurance offerings span across various categories, including Term, Savings, Child, Retirement, Wealth Creation, and Group life insurance plans.

Trusted Shareholders

We’ve built a strong organisation so you can feel confident in every conversation, every product and every promise.

The Generali Group is one of the largest integrated insurance and asset management groups worldwide. Established in 1831, it is present in over 50 countries in the world, with a total premium income of €95.2 billion and €863 billion AUM in 2024.

Central Bank of India is a leading public sector bank with a nationwide presence, operating over 4,500 branches across all 28 States and 7 Union Territories. Established in 1911, it is one of India’s oldest banks, with a legacy spanning over a century.

How Life Insurance Supports Your Bigger Financial Picture

Life insurance helps you do more than protect your family, it helps you save, plan and grow your money for the future.

Life Stage Planning

Assured Income Benefits

Financial Security

Wealth Creation

Death Benefit

Disciplined Saving

Loan Options

Tax Savings

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.

We’re Here to Make Financial Planning Feel Easy

Start at your own pace with tools and support designed to help you feel clear and confident about your choices.

Choose a life insurance plan that protects your goals & family.

Talk to our experts and find what fits you best.

Start planning smarter with our easy-to-use financial calculator.

What Our Happy Customers Are Saying

Real stories, real people— hear from those who’ve taken the step of strengthening their financial security with us.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central Life Insurance.